Now! Can we expect the selfemployed to join the pension party? AgeWage Making your money

P45 for Self Employed Workers. If you are a self-employed freelancer, the concept of a P45 may seem unfamiliar to you. Unlike traditional employees who receive a P45 when they leave their job, self-employed workers do not typically receive this form. However, it is still important for freelancers to understand the implications and documentation.

Canada PR Self Employed Program! Rao Consultants

This allows you to give the correct information to your next place of employment. You will then, hopefully, be put on the correct tax code. You should use a P46 if:- You are beginning your first paid job. You are switching from self employed to employed. You have been sent to work in the UK from overseas. You have a student or postgraduate loan.

Can You Be Employed And Self Employed?

What to Do If You Can't Get a Copy of a Lost P45. If for whatever reason, your previous employer is unable to help you, then you must contact HMRC on 0300 200 3300 (have your national insurance number ready to prove you're identity). Your previous employer submits details from your payslip of tax deductions, tax codes and your pay every.

Ambrose Moore Self Employed P45 Equipment LLC LinkedIn

Instead, if you're self-employed, you'll have to sort your own taxes, so you won't get a P45. Self-employed vs PAYE. Whilst a self-employed person is responsible for sorting their taxes through an annual Self Assessment tax return, an employed person will have tax deducted from their wages by their employer. Their employer will then send.

What is a P45 and P60? Performance Accountancy

If you're self-employed you might not receive a P60, as the form is issued by an employer. If you don't receive a P60 and need evidence of your earnings - for a mortgage application, for example - you can use an SA302 to show evidence of earnings from the past four years.. No matter how your employment ends, you should be given a P45.

Getting A Mortgage If You’re SelfEmployed Mortgage Web Site Success

Self-employed individuals generally must pay self-employment (SE) tax as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. In general, the wording "self-employment tax" only refers.

Guide To SelfEmployed Tax Returns Checkatrade

If you are self-employed and you stop working, you won't need to generate a P45 for yourself as P45s are only given to employees, and you would not be an employee of your own business if you're a sole trader. However, if you've recently become self-employed, you may need information from your last P45 to complete your first Self.

Hmrc Balance Sheet Template Accounting Equation Questions For Class 11 With Solutions Pdf

Your P45 shows how much tax you've paid on your salary so far in the tax year (6 April to 5 April). A P45 has 4 parts (Part 1, Part 1A, Part 2 and Part 3). Your employer sends details for Part 1.

You can't be selfemployed and unemployed at the same time Mike Felix

4. Preparing to begin a full-time job. There are several differences between being self-employed and holding a full-time position with another company. Understanding and preparing for these differences can help make the transition easier for both you and your future employer.

Self Employed? Here are 5 Rules Lotuswise

Going from Self Employed to Employed. Going from self employed back into the world of employment can be a daunting process. However, you don't need to worry about plucking a P45 from the air, ready to hand over. As a self employed person, you are responsible for your finances. You do an annual tax return which contains all the information.

Selfemployed (SelfEmployed)woodenfurniture maker

If you earn £12,570 or less, you will pay no tax, but you must still register for self-assessment and file a tax return if you expect to earn more than £1,000.

Employed or self

Up until now I have been self-employed this tax year. I am now being employed full time and won't be receiving any other income. I have to fill out a "P46: Employee without a Form P45" (or just known as P46) and one of the questions is confusing and I'm unsure how to answer: Your present circumstances:

The Difference Between SelfEmployed and Employed Booth Rental Business Stylists and beauty

A P45 is used to pass important information regarding pay, tax codes and deductions like student loans to new employers. That way deductions are made correctly. If you are self-employed, you'll need to use the information on your P45 to enter onto your tax return.

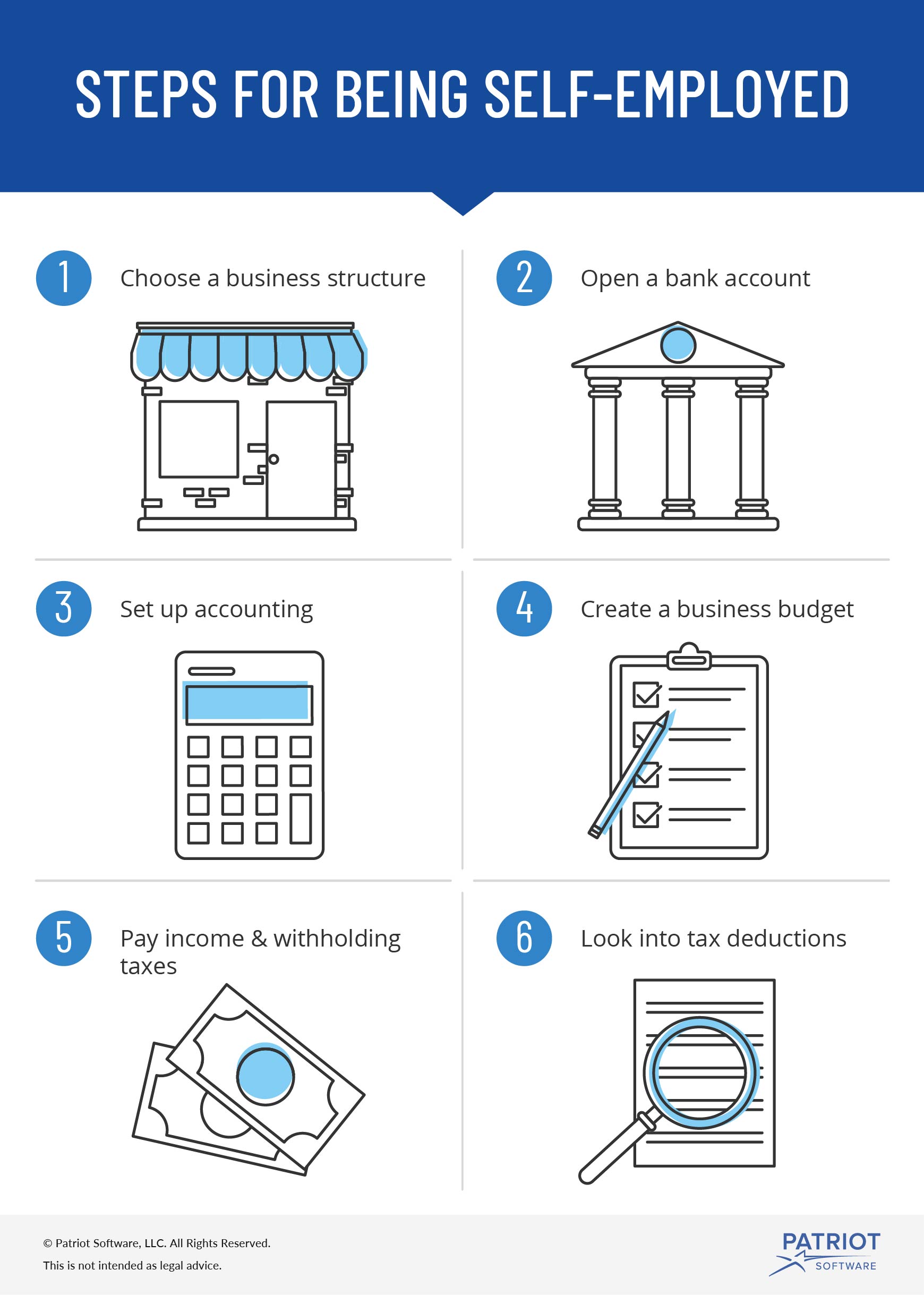

How to Be Selfemployed Steps, Tips, & More

In the UK, self-employed individuals are not issued a P45 like PAYE employees. Although they have to file a self-assessment tax return and pay their taxes according to the prescribed guidelines. We hope these few minutes of reading will help you to develop a better understanding of whether is there a P45 for self-employed in the UK.

Do You Get a P45 if Self Employed? PAYE Guide for Sole Traders

Simply put, no. As a self-employed individual, you are not an employee and therefore don't require a P45. Instead, you're responsible for completing an annual Self Assessment tax return to accurately calculate your tax liability. Self Assessment is HMRC's way of finding out how much income tax and National Insurance you need to pay.

SelfEmployed Persons Class Zee Overseas

I'm here to make sure that you'll be able to successfully add your employee. If your new employee doesn't have P45, they will need to fill out the HMRC's starter checklist. You'll also want to select the Yes, by another business option if upon setting up your employee since they have another job elsewhere.

.